With multiple tenders on the go and tight deadlines to hit, regularly assessing your bidding universe, performance and results can be hard to maintain.

But without this critical activity, it is hard to stay agile and alert to new threats and opportunities or identify areas of your bid process for improvement.

In this article we identify and discuss the top Tender Metrics to monitor to help you stay ahead of the game.

Tender Challenges

Monitoring, reviewing and understanding your bidding activities, performance and results as well as your competitors is essential. Without it you will be relying on past perceptions and success rates as well as limited knowledge and understanding of your bidding universe. This will make it harder to identify:

- Areas for bid process improvements

- Gaps and required improvements in tender response quality

- New threats and opportunities within the marketplace.

Let’s now look at the recommended Tender Metrics to ensure your business stays agile and focused on continuous improvement and growth.

1) Contracts Awarded

The whole focus of your bidding activities is to win contracts to meet and hopefully exceed your business objectives and financial goals.

So, you need to track and regularly monitor your bid progress and status against your business KPIs. This is the foundation of any strategic review. If targets are not being met, then strategies may need to be tweaked or changed.

This will be dependent on your review period and the extent to which you are falling short of your targets.

For example, if over Q1 and Q2 you have fallen short of your sales targets by 30%, then you may need to reconsider focus for Q3 and Q4. This may include reviewing your targeting strategies, your qualification criteria or the details and quality of your bid responses and evaluation scores.

2) Tender Win Rate / Win Ratios

Tracking your win rate or win ratio is an essential tender metric and indicator of the success of your bid strategies, tactics and processes.

Fundamentally these two metrics are the same, just expressed differently, either as a percentage or as a ratio.

For example, if a company submits 30 bids and wins 15 of them, its win rate would be 50% or 1:2. If they submit 30 bids but only win 6 then the win rate is only 20% or 1:5.

As to whether your win rate is good, or poor will also depend on your market share and the number of competitors you are against for each tender. In some markets with a large number of competitors and solutions, a win ration of 1:5 may be a good rate, in others it wouldn’t be.

However, if your win rate or win ratio is considered on the low side, you will need to be asking yourselves if the tenders you are bidding for are the right tenders?

Consider your win probabilities and how much time and resources you are wasting on these lost bids. This valuable time could be better spent finessing your better-matched opportunities giving you higher win probabilities and improved ROI.

3) Bid Conversion Rates

It is also worth reviewing your conversion rates to identify any stages of the bid journey that are causing particular problems.

For example, if your ‘sourced tenders to qualified pursuit action’ conversion rate is very low, you may need to review your process. This could be an indication that your sourcing criteria (procurement codes and keywords) may need refining to better filter out irrelevant opportunities. Alternatively, your qualification criteria may need reviewing in case you are missing some valuable tender opportunities.

Example conversation rates include:

- Number of sourced tenders to qualified tenders

- Number of qualified tenders to submitted tenders

- Number of qualified tenders to won contracts

- Number of submitted tenders to won contracts.

Review of wins, losses and conversions ensures focus is being given to your best-fit tenders with high win probabilities.

4) Cost per Bid

Bidding for high-value contracts is a costly endeavour with potential for a very low return on investment.

Using a cost per bid metric for the preparation and submission of your bids can be a useful tender metric and indicator of the efficiency and effectiveness of your bidding processes.

It can also be used as part of your qualification criteria and process. For example, you may be contemplating pursuing a bid with a low win probability during a quieter period. But this may be too high a risk when considered against your cost per bid metric and the potential return on investment. You may decide your time is better spent, for example, on reviewing, updating and improving content with your Bid Library, ready for better matched opportunities.

Establishing your base cost metric can be a challenging calculation given the complexity of the activity. Both in terms of the variety of tenders pursued and the teams and time involved in the preparation and submission process.

You will need to consider the cost associated with not only your Bid Team but also your Subject Matter Experts and Approvers. It may be that you need to ask contributors to record time spent on several tender projects to secure a base cost.

5) Competitor Bid Activity

Bidding for high-value public or private contracts is highly competitive. Without a good understanding of your competitor landscape and activities your business is putting itself at risk.

Existing competitors may introduce new products and services, expand into new markets or grow their market share. While new competitors may well enter your market without your awareness.

Tracking and understanding competitor pursuit activities and criteria (such as procurement codes, keywords, geographies) may also alert to new areas or markets that you have missed or are not currently competing in.

Equally important will be to track where competitors are successful in winning your own contract renewals and understanding how they achieved this.

Understanding your competitor universe can also help you develop and define stronger competitive differentiation within your tender response and submissions, hopefully securing you higher evaluation scores and more tender wins.

Metrics to monitor may include competitor:

- Win/loss/conversion rates

- Won contract values

- Industries, products and services pursued.

6) Market Share in Bidding Universe

It is very easy for businesses to assume they know their bidding universe and retain a certain market share (stemming from past success rates and perceptions). However, it is vital to track this metric, certainly on a yearly if not quarterly basis to ensure you are basing your strategic decisions on the correct competitive scenario.

You will need to consider the make-up of your market share. This may stem from a mix of both bid and non-bid related sales. So the metric below may be slightly different for your business.

Having a deeper understanding of your competitor landscape will help you establish your market share and any negative or positive changes to your position.

Being able to track your market growth or contraction is vital for long-term sustainability.

7) Bid Quality Score

Establishing and regularly monitoring your average bid quality score will help alert you to inconsistencies and problems in your bid creation and submission activities.

This can then act as the impetus to undertake a more in-depth review of tender questions, responses and individual evaluation scores. You can then identify gaps and take action to improve individual questions. Any improvements gained can secure you extra points and possibly the difference between winning and losing the tender.

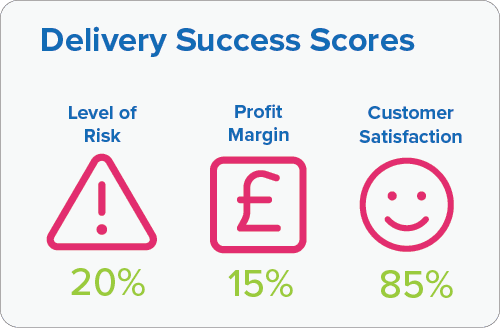

8) Contract Delivery Success

It is also important to review the success of your won contracts and bring any learning and improvement ideas back into your tender process.

Establishing profit, risk and customer satisfaction scores for each won contract on completion will help you build a picture of your most successful contracts and to focus new bidding strategies on winning more of the same.

9) 12 Month Future Bids

Forward planning is also an essential activity for any business. This allows you to set realistic targets, effectively resource bid activities and ensure that won contracts can be delivered to a high standard.

It is also essential to ensure existing contracts are re-won. These are the most cost-effective way of bringing in ongoing revenue to the business. You certainly do not want to lose an existing profitable contract to a competitor!

There may also be competitor contract renewals you want to try and win but others you know are just not worth competing for.

Having this insight and knowledge will help you to focus your efforts on best-matched, high win probability tenders, rather than taking a less effective ‘bid for everything’ approach.

You may also have plans to enter new markets, geographies or product areas and require comprehensive insight and forward planning to be successful in these new endeavours.